Inflation.

In this blog I will be discussing the following points

·

What is inflation and how does it happen?

·

Why is it such a problem?

·

How might it affect you?

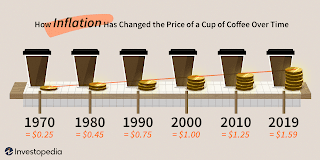

In layman’s terms, inflation is the value of money decreasing and the cost of everything increasing. This means that common products like chocolates at your local grocery shop to house prices all increase relative to your local currency. This happens because the currency’s purchasing power decreases due to an increased level of money printing in an economy causing an excess supply of the currency. Assuming demand remains at a lower level as to the supply, this would cause the price to increase due to the supply and demand graph. However, this can also happen by a decrease of demand of the currency from other countries simultaneously, but this is rare and not as significant as the first scenario.

Low levels of inflation are upheld by governments and central banks around the world to increase the velocity of money, the rate at which money changes hands, by opposing long term savings in traditional methods, this occurs by making those savings have less value each year urging the savings to be spent and not saved, this bolsters GDP figures as more money is exchanging hands, being spent by consumers, instead of being saved. Which makes the government look good as well as actively promoting foreign direct investment (FDI) from transnational corporations (TNCs) because it broadcasts a growing economy. For example, the Bank of England targets a 2% per annum inflation rate meaning that savings become 2% less useful per year therefore in order to get the most out of your money you would want to spend the money as early as possible. Thus, increasing the velocity of money, increasing the GDP of England. Moreover, inflation regularly occurs after some sort of large-scale crisis. For example, in Weimar Germany, after World War One, the treaty of Versailles forced Germany to pay large sums of money to the allies as reparations and in 1923 they simply were unable to do so. As compensation France and Belgium occupied Germany’s heavily industrialised Ruhr valley. This reduced the income of the German government and to counter this occupation, the president at the time asked all the workers to go on strike, paid for by the German government. And as Germany did not have the money to do this, they started printing loads of money to fund the scheme. This led to hyperinflation to occur in which the inflation rate exceeded 50% per month.

Then why is inflation a problem when it can attract growth

in the form of FDI? Traditionally, if house prices increase by 25% in a year,

then it would be celebrated because, on paper some people will have made large

profits, on the other hand, if the cost of essentials such as groceries

increase by 25% many more people wouldn’t be able to afford enough food and be

pushed into dire situations. This would point to large levels of inflation

which is very unhealthy for an economy as their citizens will be forced to pay

higher prices for everything increasing the cost of living by the inflation percentage

and the governmental welfare programs such as state pension and unemployment

benefits, which the government is bound to provide, increase in cost at a time in

which government spending is high and there are already other significant costs

to combat the crisis, which makes the government unpopular for not delivering

on their promises. In Weimar Germany the hyperinflation was so great a loaf of

bread began to cost 201 billion marks (German currency at the time). This

reduced the state into a bartering community and millions were no longer able

to feed themselves, poverty rose significantly, there were multiple rebellions

in the span of a couple months, all the government schemes collapsed, and the

only solution was to change the sovereign currency.

So why is inflation a hot topic being discussed by many economists

as of now? In 2020 the USA was hit incredibly hard by the coronavirus pandemic-

over 30 million people infected and a half a million people dead. While the

social impacts of this crisis are horrifying, the pandemic has also, undeniably

caused a large negative impact on the economy, millions are still out of work

after lockdown restrictions being eased, many small, medium, and large

businesses have closed their doors because of it, stable industries like

tourism, hospitality and in-person retail have all become destabilised and

crippled for the foreseeable future furthermore at this time of peril many

trillions of dollars have been used as stimulus checks . All these negative

economic impacts forced the US to print more than 40% of active money supply within

the last 16 months. This worryingly seems like the foundation of a hyperinflation

crisis. on the other hand, some argue that America is such a large, influential

economy that it is immune to hyperinflation. Well, this might be true as the US

Dollar is regarded as the world’s reserve currency. But this is almost irrelevant

nowadays, all it means is that most international trade happens in US Dollars as

it is the most widely recognized currency in the world which partially protects

its value to be inflated too much however it does not completely protect the US

Dollar against high rates of inflation moreover, the Consumer Price Index shows

that the costs of goods for a household have increased 5% each month from April

to July of 2021 according to the U.S. Bureau of Labour Statistics this denotes that

inflation is occurring at a rapid rate as CPI is a good measure for inflation in

household essentials in day to day life as it measures the percentage rise or

fall of prices per month.

Why is it a concern for any of us not living in the US? Because

of the reasons I stated for the defence of the US Dollar previously, the US’s

economy is so large and influential that shockwaves of the supposed inflation

will have clear implications for every economic power in the world whether it

be the UK, India, or Japan. This is due to a shrinking in a vital trade partner

for all their exports as well as imports which will cause prices of all their

products to change dramatically (depending on the product). This trend has been

seen many times in which the US suffers through an economic crisis and the rest

of the world also has a separate crisis of their own due to it, for example,

the Great depression caused Weimar Germany to collapse, out of desperation of

its people, into Nazi Germany. And the 2009 housing bubble crisis in the US caused

a large reduction in the size of the UK economy. So, who knows what crisis is upcoming

after the US inflation crisis?

Also I would like to address this comment from my minimum wage article,

I partially agree here, many workers will have additional disposable income, however many people will be forced to use unemployment benefits from the government and the 550,000 people working at $15 per hour will not be taxed heavily enough from the government to provide for the unemployed, therefore there will be a net loss of revenue for the government, furthermore the sizes of most businesses will decrease, due to significant losses of workers. They would not be able to retain 550,000 people as they would be less efficient (less incentive to put in overtime or do more shifts) and would cost the business more money, and due to less workers, less management positions will be available. thus more unemployment. Moreover this would make the management positions more competitive as there are many managers out of jobs thus reducing the likelihood of an entry level employee to get promoted. Plus a decrease in the size of many businesses will cause a shrinking of the economy as a whole and an increase in the CPI index, increasing the cost of living as businesses increase the price of their products so that they can afford to retain as many workers as possible. Thank you Sam, for the comment, I appreciate an interest in the topic as well as your engagement.

Comments

Post a Comment