Types Of Investment

There are a variety of investment types, I am not talking about crypto currency but more about traditional, predictable investment, for example:

·

Equity

·

Bonds

·

Property

What is Equity ownership?

Equity is when you purchase a miniscule fragment of a

company, therefore having ownership in the losses and profits the company made.

If a certain individual or company owns large amounts of equity in a company,

they become a shareholder. The owner of a business is simply the person with the

largest amount of equity in a company. For example, Elon Musk is the largest

shareholder of Tesla and thus the owner of the business. Stock is just traded

equity.

How do investors assess whether they should invest?

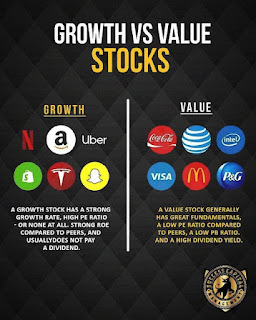

They first judge which of the companies are worth investing

in by looking at their finances (oversimplification, too much information for

this blog). Then they investigate whether the equity is a value equity or a growth

equity.

How are they different?

A value equity- meaning that the stock is currently

undervalued and has high prospects to grow in the future. Or a growth equity-

which has high growth, most likely overvalued with higher volatility (value

fluctuations).

Value equity is a preferred method of investment in

large wealth management funds and Warren Buffet as it has a low risk (of losing

money) and usually outperforms growth equity in the long run (5+ years). However,

growth equity produces high reward paired with a higher risk, generally outperforming

growth equity in the short run, thus is popular with several investment firms.

What are bonds?

These are fixed income investment. Bonds are very stable; this

is because they are not influenced by the world, and they are set to grow by a

certain percentage per-annum (yield) until they mature (the bond cannot gain

more value). Based on time of maturation of bonds there are short-term (< 3

years), medium-term (4-10 years) or long-term bonds (> 10 years). However,

the only thing that can reduce the value of bonds outside of a crisis, would be

if inflation rates are higher than the bond’s percentage increase. Again, there

are two types- Gilts and Corporate.

What is the difference?

Gilts are government issued; they are more safe than corporate

bonds as they are protected by the issuing government. Corporate bonds

are less safe as they are insured by the company, moreover the bond has a

higher yield than Gilts. If a company goes bankrupt, bond owners can put

forward a claim to receive a portion of the value of their bond, thus corporate

bonds are less reliable than government bonds.

What does property investment consist of?

This deviates slightly from the traditional view of property

investment. Most think that this would be leasing, buying, and selling houses or

offices for a profit, through remodelling et cetera. They would be right, as

this is called direct property investment except there is another type

of property investing. This would be indirect property investment this

consists of buying stock/equity in trust companies, Real Estate Investment trusts.

However, property investment has a few problems. Such as inaccurate valuation

of funds, simply due to the nature of housing. Which could cause large losses,

as in the world of finance, accuracy is highly important.

There will be a part 2 of different types of investments, this

will be coming out on the 19th November. Part 2 will go over the

more interesting types of investment, the type which is commonly used by hedge

funds and other large financial institutions.

Comments

Post a Comment