Hierarchy of Money and Banks, How Does Banking Actually Work? (Part 1)

I have written a blog on a similar topic to this, my “History of Banking” blog, in all fairness, I will admit that the blog was somewhat dull. But since then, I have begun a course on “The Economics of Money and Banking” and have found a new appreciation for the intricacies that are in the world of financial intermediaries. And believed it wise to share the knowledge that I have gained from the course with the readers of my blog.

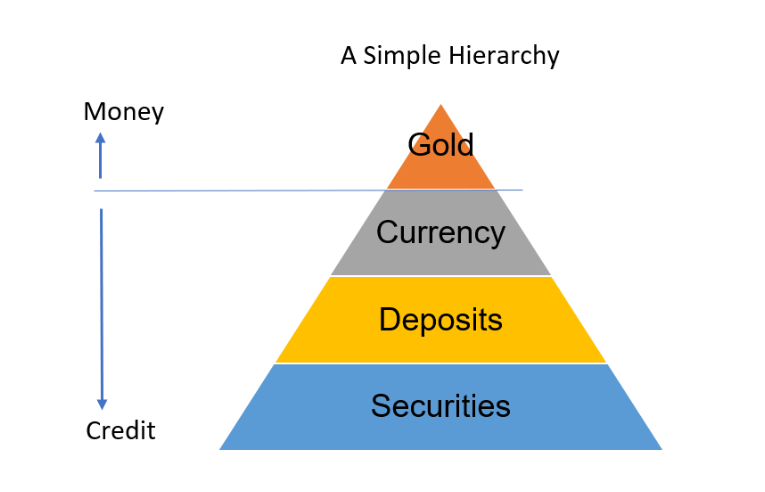

Hierarchy of money

I will begin with the hierarchy of money. What does this mean? In short, not all stores of value are the same. For example, you cannot use an M&S gift card to buy a Microsoft Xbox. The hierarchy goes as such: gold, currency, deposits (i.e., in a bank), securities[1]. As shown below[2].

This doesn’t apply perfectly in today’s world since international trade occurs in USD and not in gold, since it is the world reserve currency. Yet, before the USD was the world reserve currency, international trade occurred in gold. And the reserves for all the major central banks[3] are kept in gold. Therefore, gold is the highest form of currency. Then, one rung down in the ladder is currency, in the UK, GBP is used, and is accepted everywhere, but most notably, the currency of the respective nation is held by banks as reserves. Another level down, deposits. These are the “reserves” of most individuals and are used as (financial) capital for banks. Finally, securities are at the bottom of this list, this is because they are not held by anyone as reserves.

Why is

this important?

This is important since the value of the currency used to be

derived from gold (the gold standard), hence, if the nation did not own enough

gold, the central bank could have a liquidity[4]

and/or solvency[5]

issue. An illiquid/insolvent bank is very dangerous. This is because it can

lead the bank to default[6]

on its loans and obligations. For reference, the 2008 financial crisis occurred

as a result of insolvent banks (too much depth to explore now, but if you want

a blog on this, let me know via Instagram). The Fed had to provide liquidity

for the major financial firms which survived the crash. Which it did by “printing

money”- quantitative easing (QE). The rest of the major banks subsequently

began their own version of QE.

This is also important since in the next blog I will be

talking about the method that all banks use for transferring money and how they

make a profit.

[1] Securities-

a financial instrument, typically any financial asset that can be traded. I.e.,

stocks or bonds

[2]

Note: the pyramid only states that gold is money, but some experts may believe

that currency is also a form of money.

[3] The

major central banks are: the US’ Federal reserve system (Fed), the European

Union’s European Central Bank (ECB), the Bank of England (BOE), The Bank of

Japan (BOJ), and the Swiss national bank(SNB)

[4] Liquidity-

a measure of the cash and other assets banks have available to quickly pay

bills and meet short-term business and financial obligations.

[5]

Solvency- a measure of the ability of the bank to meet its long-term debts and

financial obligations.

[6]

Default- not be able to pay a loan/obligation

Comments

Post a Comment