Why is there high inflation?

In this blog, I will be covering:

·

Why prices are rising

·

What should the government/ central bank do?

Inflation is the general increase of prices in an economy,

typically shown by a rise in the consumer price index (CPI). CPI is the measure

of the change in the price of consumer goods weighted by goods and services

purchased by households, CPIH is CPI plus housing costs. In the past 12 months

up to June 2022, CPIH has increased by 8.2%. This means that consumer goods in

June 2022 are 8.2% more expensive than they were last year, effectively

reducing the real value of money. Inflation can be caused by many things: a

reduction in short-run aggregate supply (SRAS)[1]

and/or an increase in aggregate demand (AD), an increase in the money supply

(according to Fischer’s equation MV=PT or MV=PQ) or a change in foreign

exchange rates (depending on whether the country is a net exporter or

importer).

Why has inflation (in the UK) been so high?

The root cause is the

pandemic. During the fallout of the pandemic, the government was forced to

support the public as it was a time of severe crisis. This was done primarily via

the massive furlough scheme (£70 billion was distributed to 11.7 million people).

Overall, the UK government spent £167 billion more than was planned in

2020/2021. The central bank also took actions to support the public, for

example, cutting interest rates down to 0.1%, allowing more people to take

low-interest loans and promoting borrowing; hence spending. Furthermore, the

BOE also scaled up quantitative easing (QE) significantly, the BOE printed

money for and purchased £424,400,000,000 worth of government debt in the form

of gilts (a government bond used to finance public expenditure).

In 2020 and 2021, the inflationary effects were cancelled

out by the net deflationary effect of the pandemic. This was because of a grand

reduction in AD due to national lockdowns. This is because people were not

spending any money commuting to and from work, millions were getting laid off

et cetera. Causing a reduction in spending. However,

it should be noted that there was a reduction in AS caused by disruptions in

supply lines, reducing the magnitude of the deflationary pressure caused by the

pandemic.

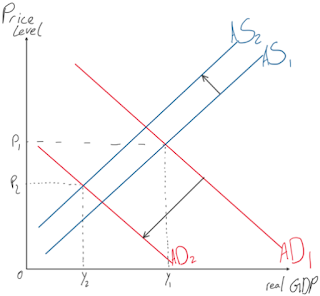

In figure 1, the point (Y1,

P1) denotes the equilibrium

before the pandemic and the point (Y2, P2) is a representation

of what would have happened if there was no government intervention, High

deflation and a sharply reduced real GDP.

The next diagram is a little bit confusing[2]. So the diagram

is similar to the previous one. AD1 and AS1 still

represent the situation before the crisis, and AD2 and AS2 represent

no government stimulus. However, the additional lines are there to represent what

happened in the real world. With the support of the government and central bank,

AD didn’t fall significantly, hence resulting in AD3 instead of AD2.

This is what we saw in 2020/21. Prices didn’t fall but rose by a small margin as

shown by P*, while the country had a fall in real GDP, Y*. So what is AD4?

AD4 is the combination of stimulus (+multiplier

effect) and the economy returning to its original capacity. Due to the enormous

amount of stimulus in the form of government spending and central bank’s QE and

low-interest rates, there will be a significant multiplier effect as all of the

schemes used in the fallout of the pandemic were used to help the least wealthy

in the UK, meaning that most of the money pumped in the economy would have been

spent rather than saved. The multiplier effect’s formula is 1/(1-MPC), the

higher the marginal propensity to consume (MPC), the larger the multiplier

effect. Hence, there would have been a very high multiplier effect, causing a

large rise in real GDP and inflation. Furthermore, as the economy returns to normal

(AS1=AS4), the AD will be pushed up even higher. That is where

AD4 comes from. As a result, the new price level will rise

drastically, reaching P2*. NOTE: I should have drawn the AS curves with

curves to show that Y2* doesn’t increase as much as it seems on the

graph.

I do not believe that we are currently at (Y2*, P2*)

yet as there is a larger time lag for the QE and low-interest rate. We are currently

between (Y1, P1) and (Y2*,

P2*) since GDP has increased to a larger size since before the

crisis and as inflation is currently rising

What

should the authorities do about this?

An inflation/cost of living crisis is not good for anyone,

so what should the parliament/central bank do? There is a need to reduce prices

and attempt to raise incomes, hence I would lean toward a contractionary monetary

policy to reduce the MPC, urging people to save while also having a slightly expansionary

fiscal policy. Why have I suggested an expansionary fiscal policy? This is because

a tight fiscal policy would be detrimental in the short run and doesn’t need to

occur for the long run to be unchanged. In a cost-of-living crisis you do not want

to have less money, which is why the government being criticised for carrying

out contractionary fiscal policy, and why some people are unable to afford

certain essentials (I will go into why energy prices are rising next blog).

This inflation is because the authorities were unable to predict the perfect

amount of expansionary policy that should have been used. However, this is

unavoidable due to humans not being able to see the future. To stabilise the

economy, the people should be urged to save money rather than be forced to have

less of it. I believe that this route is the only way to sustainably solve the high

inflation.

[1] I will

only be referring to short run aggregate supply for this blog as long run aggregate

supply is independent of prices

[2] In

figure 2, I will be focussing in the changes in AD over AS because much of the

damage done to businesses was because of the contraction of AS as a result of

the fall in AD with the rest only accounting for temporary supply chain issues.

Comments

Post a Comment